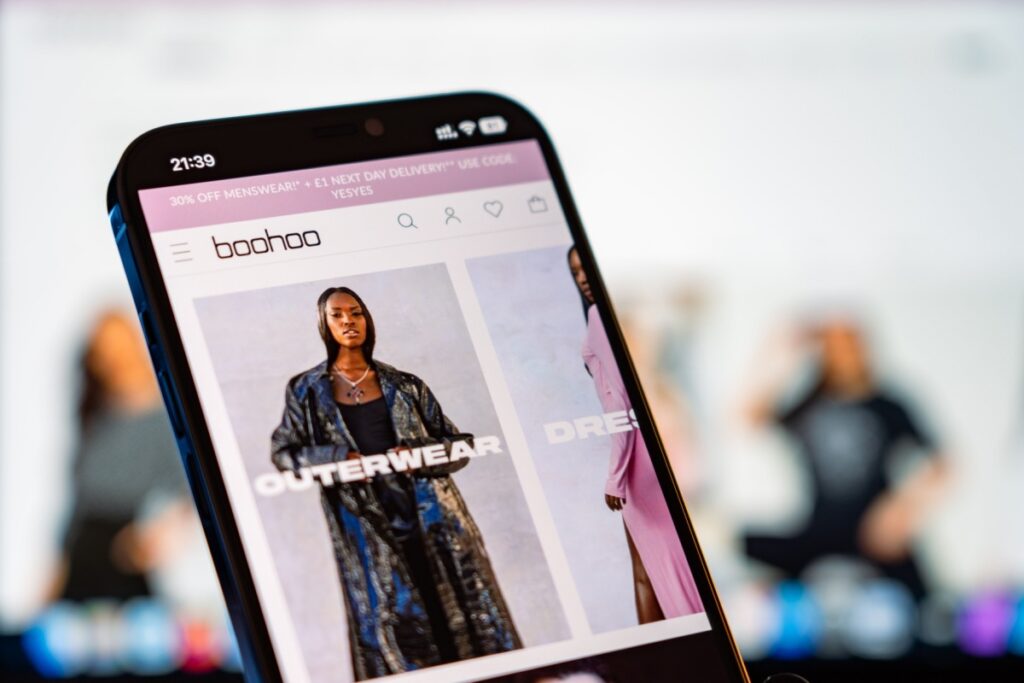

Mike Ashley’s Frasers Group has upped its stake in Boohoo to more than 25% as it continues to build on its “strategic investment” into the fashion retailer.

The retail giant – which is the largest shareholder in the online business – increased its holdings from 24.04% to 25.02% on Friday (26 July).

The group has been steadily building its holding in Boohoo since it first made a “strategic investment” in June 2023. In February, it solidified its position as the retailer’s largest shareholder taking a 22% stake.

Frasers Group chief executive Michael Murray fuelled takeover speculation late last year when he described the group’s investments into Boohoo, as well as Asos, Currys and AO, as “mid-flight”.

Speaking to The Telegraph, he said: “All I can do is talk about how it looks very obvious afterwards.

“Flannels was an acquisition, and now it seems normal that Flannels is a part of Frasers Group. And Game, you think: why would you buy 30% of Game? Afterwards, it’s all very obvious.”

Frasers also grew its holding in Hugo Boss earlier this month, taking its investment in the company to around £415m (€490m).

The Sports Direct owner said it now owned 5.6m shares, 7.99% of Hugo Boss’s total share capital, as well as 13.81%, via the sale of put options.

Click here to sign up to Retail Gazette‘s free daily email newsletter