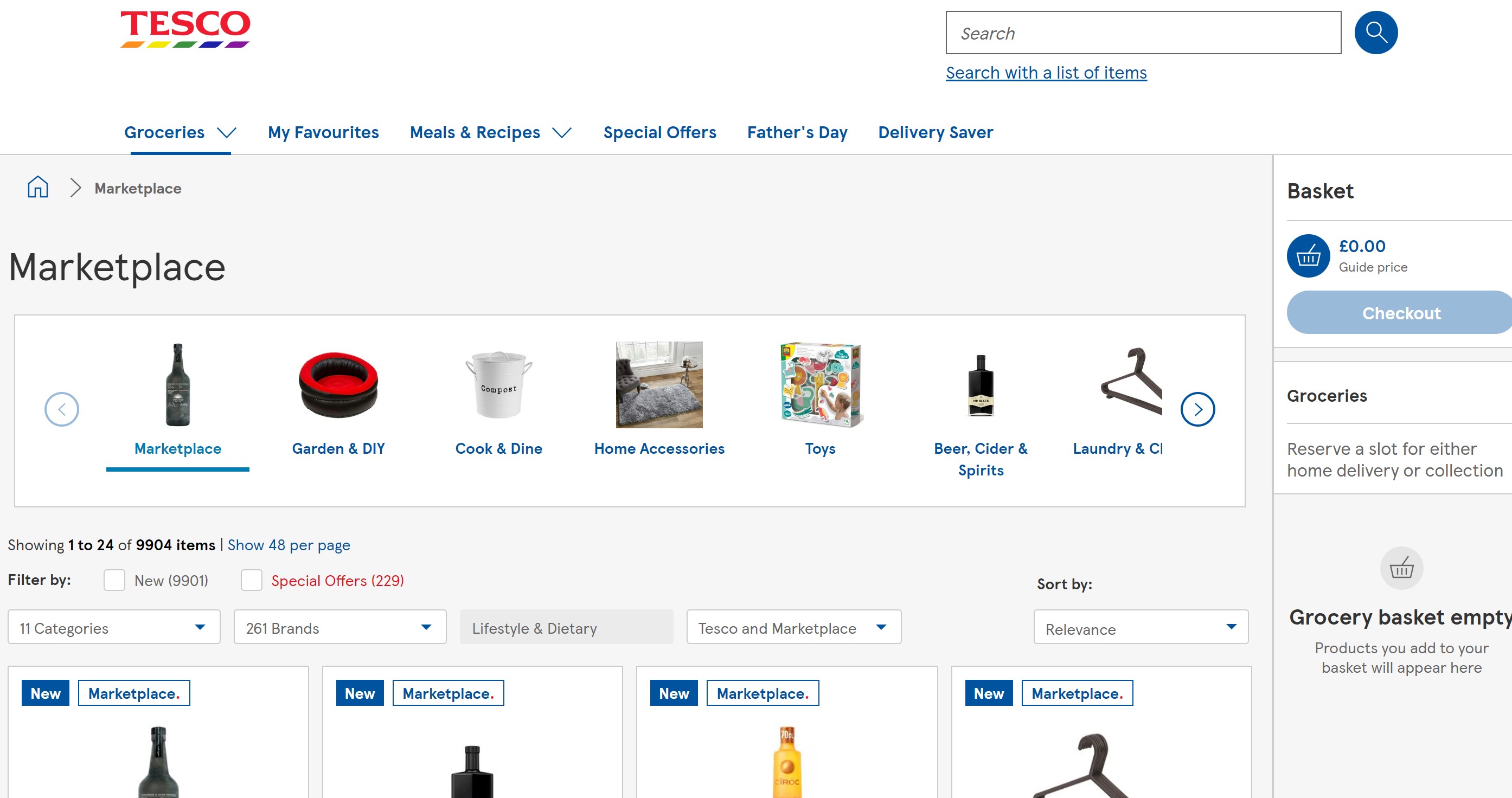

Tesco launched a new online marketplace earlier this week, which allows customers to shop thousands of products from third-party brands.

The grocery giant claims the new venture would make the Tesco website a “one-stop shop for everything customers need” once it reaches full scale.

Tesco marketplace director Peter Filcek describes the launch as a “really exciting moment” which will make it “even more convenient for customers to shop at Tesco”.

“We’re constantly looking at ways to improve the shopping experience for our customers, and our new marketplace offers them the same great quality and value they have come to expect from Tesco across an even bigger range of products, from our specially-selected partners,” he says.

It launched with roughly 9,000 products in categories such as garden and DIY, home accessories, cook and dine, toys and pets from brands including Tefal, Silentnight, Tommee Tippee, and Charles Bentley.

However, this isn’t the first time the grocery giant has dabbled in the world of marketplaces.

In 2012, the supermarket launched a marketplace on Tesco Direct. However, the loss-making venture was scrapped in 2018.

So how is the retailer’s marketplace different this time around, and will it be a success?

Second time lucky?

The UK’s biggest grocer claimed that Tesco Direct formed a “small, loss-making part of the business” which had “no route to profitability” when it decided to ditch the division in 2018.

Former Tesco UK chief Charles Wilson said the decision was made as it wanted to focus on one website so shoppers could purchase their groceries and non-food products in the same place.

Tesco had been running two separate online business at the time: Tesco.com for groceries and Direct for household goods and clothing.

However, that has changed now with Tesco now selling through one app. In fact, the grocer flags that for customers its marketplace will be “seamlessly integrated into their online grocery shopping experience” and can be shopped via Tesco.com and its grocery app.

Shoppers will also be able to earn Clubcard points on all purchases, with the supermarket flagging that the launch “builds on Tesco’s success as the UK’s leading online retailer with 22 million Clubcard members and 1.2 orders each week on Tesco.com”.

PwC senior retail adviser Kien Tan says its biggest USP in launching a marketplace is its vast Clubcard membership, more than half of whom use its mobile app.

“The expansion of Clubcard Prices and integration of multiple Tesco shopping, payment and loyalty apps into a single ‘super-app’ has increased membership sign ups and given the almost 30-year-old loyalty programme a new impetus,” he says.

“This serves as a ready and willing customer base for the non-grocery products being added on the marketplace.”

GlobalData associate analyst Sophie Mitchell agrees and says the ability to collect Clubcard points may encourage avid loyalty scheme members to use its marketplace over other obvious options.

Times have changed since its Tesco Direct push.

Tan explains that its original marketplace launch was part of its strategy to “diversify the supermarket away from grocery” at a time when it was exploring “everything from restaurants to own label tablet computers”.

He elaborates: “It was a separate stand-alone website, not fully integrated into the wider Tesco.com experience, and almost trying to take on Argos – four years before Sainsbury’s acquired Argos.

“It was closed at the same time as other non-core businesses during a period when Tesco was focused on turning around its core grocery business.”

As Tan says, timing was not on Tesco’s side during Direct’s tenure. Over that period, it had faced an accounting scandal, and was desperately trying to rebuild its core business after shoppers started deserting it. It made an eye-watering £6.4bn loss in 2014/15, the worse in its long history.

However, it’s a different story this time around with the supermarket in rude health, as profits have more than doubled in its last financial year.

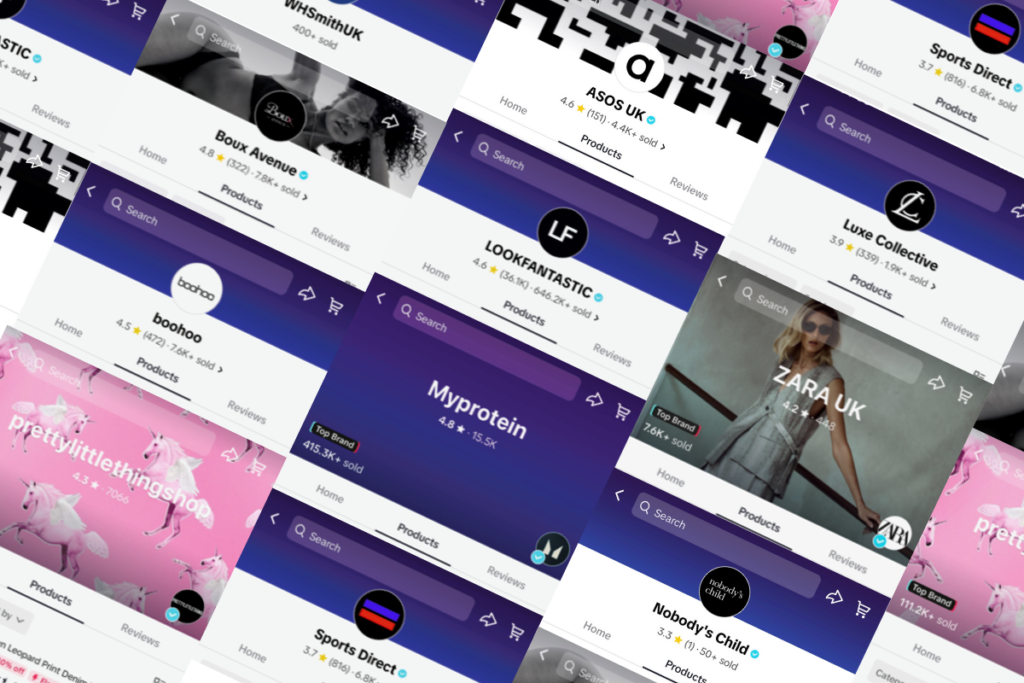

Not only is Tesco in a different place, so is the online market. It is much bigger now, and the marketplace model is now tried and tested, with retailers including B&Q and Superdrug now operating fast-growing platforms.

The model has made its way to the world of grocery too, with global giants Walmart, Carrefour and Kroger all launching their versions.

Tesco Marketplace is also a different proposition this time around.

Tan says: “The new Tesco Marketplace is positioned more as a service for existing Tesco customers – of which there are many – rather than trying to compete head-to-head with Amazon.

“Its range and assortment is more edited and focused on a smaller number of proven marketplace suppliers, albeit more sellers are in the process of being added.”

“This will also help limit Tesco’s exposure to negative customer feedback for any issues outside its control, such as late deliveries or fulfilment errors.”

The vendors on the marketplace will fulfil orders themselves. Shoppers will pay for any items from third-party sellers separate from their grocery order with items carrying their own delivery charge

Sellers will be monitored on key delivery metrics to ensure they adhere to Tesco standards.

JDM Retail founder and CEO Jonathan De Mello applauds this approach as “there was a lack of focus” on Tesco Direct.

JDM Retail founder and CEO Jonathan De Mello applauds this approach as “there was a lack of focus” on Tesco Direct.

“The initial focus on only a few curated suppliers is a good idea – it can incrementally grow from there,” he says.

Should Amazon be worried?

The leader in the world of marketplaces is undoubtedly Amazon, and the online giant has been encroaching on Tesco’s turf by selling more and more food. The ecommerce behemoth has tie-ups with the likes of Iceland and Morrisons on its site.

But will Tesco’s marketplace launch turn the tables and become a threat to Amazon?

Tesco’s Filcek played down the competition when speaking to The Grocer. “Our launch is nowhere near Amazon’s scale. We’re really trying to make sure we hit those marks on performance, on quality, on trust and that will always be our guardrail, it will always be our watchword.”

De Mello says: “It will provide an alternative to Amazon, but Amazon are far and away the market leader in this area and Tesco is unlikely to come close to challenging their dominance with their offering.”

GlobalData’s Mitchell agrees that the grocer is “unlikely” to be a threat to Amazon, due to the advantages the online giant has from “being in the game for so long,” its extensive consumer data and its many “practical advantages”.

One of these advantages is Amazon Prime, which gives its many subscribers unlimited next-day delivery.

Mitchell says: “Tesco Marketplace is currently offering free standard delivery – not next day – for any order over £50 and a £3 delivery charge for orders under £50. Thus, consumers are not going to be swayed away from Amazon for cost-effective delivery or speed purposes.”

She adds that it will also be difficult for Tesco to compete with the volume of products and choice within categories that Amazon offers.

IGD insight manager Michaela Jay says it is too early to assess whether the launch pose a significant threat. However, she adds: “We estimate that Amazon UK generated online non-grocery sales of £21.21bn in 2023 – even taking a fraction of this market would be significant.”

“Amazon’s wide range, competitive pricing, rapid delivery and Prime membership makes it extremely competitive. Shopping habits are well engrained across the UK and it will take time for Tesco to scale its marketplace business.”

De Mello does believe that Tesco Marketplace has “the potential to become a reasonably strong revenue stream” for the grocer, but notes it will always remain less profitable than it selling its own products directly to shoppers.

However, it is a capital light way of expanding its range, and enticing its vast number of shoppers to spend more with the grocer – especially Clubcard fans.

While it may not reach the heady heights of Amazon, analysts are more positive on Tesco Marketplace’s fate this time around.

Click here to sign up to Retail Gazette‘s free daily email newsletter